Do all cryptocurrencies use blockchain

With many practical applications for the technology already being implemented and explored, blockchain is finally making a name for itself in no small part because of Bitcoin and cryptocurrency free roulette game. As a buzzword on the tongue of every investor across the globe, blockchain stands to make business and government operations more accurate, efficient, secure, and cheap, with fewer intermediaries.

Cryptocurrencies and blockchain technology are often regarded as the same thing. This makes it seem like a cryptocurrency cannot exist without an underlying blockchain technology. But is this really the case?

Blockchain is a decentralized and secure system for recording information. Unlike traditional databases controlled by a central authority, blockchain stores data across a network of computers, ensuring that records cannot be altered or deleted.

Are all cryptocurrencies mined

However, cryptocurrencies don’t have a central authority; rather, the cryptocurrency community and, in particular, cryptocurrency miners and network nodes manage them. For this reason, cryptocurrencies are often referred to as trustless. Because no single party or entity controls how a cryptocurrency is issued, spent, or balanced; you don’t have to put your trust in a single authority.

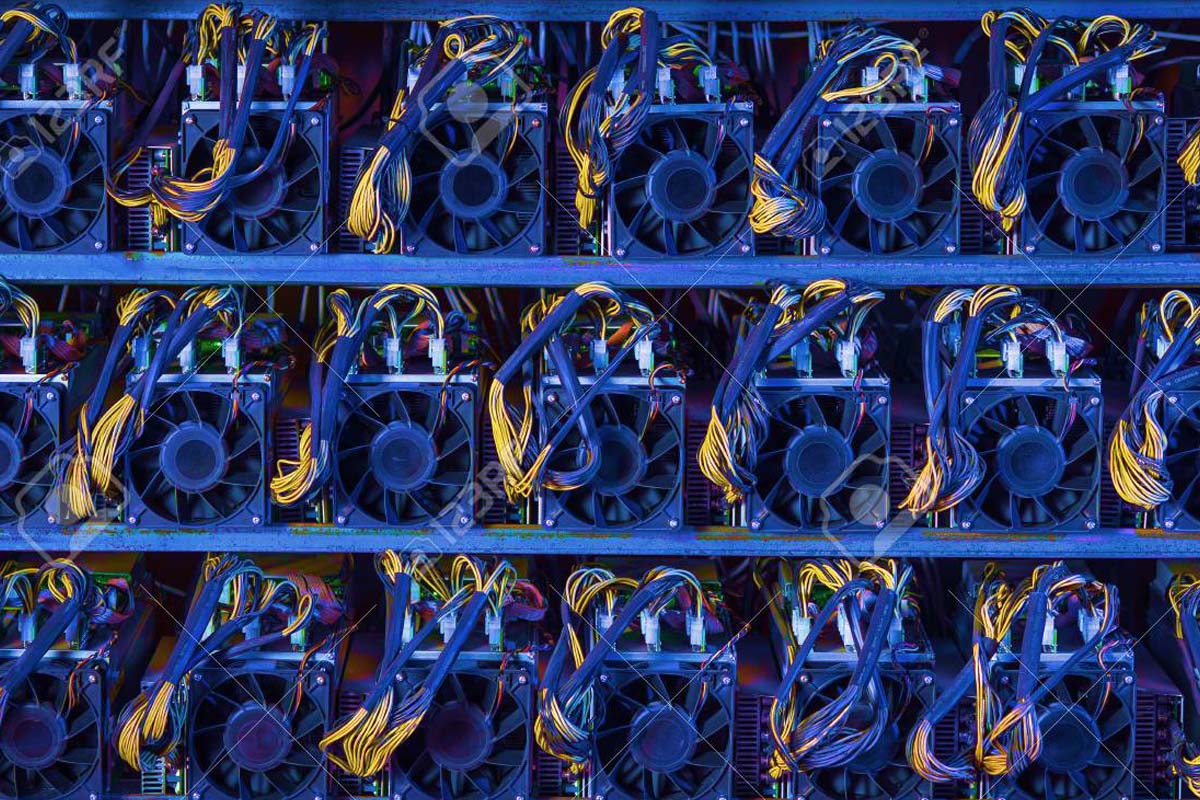

“The challenge that comes with mining as a business is that you have the upfront cost of mining equipment plus the constant costs of electricity (for running the equipment 24/7), but you are only rewarded cryptocurrencies if you successfully outcompete others in puzzle solving,” said Benjamin Cole, a cryptocurrency expert and professor at Fordham University’s Gabelli School of Business.

However, if they do not have the skillset or the computer science knowledge to audit code, they can choose to trust that other people, more knowledgeable than them, understand and monitor the system; they can trust the overall blockchain community that is managing the particular cryptocurrency.

If even one of these six conditions aren’t met, a cryptocurrency will fail because it can’t build enough trust for people to reliably use it. The process of mining solidifies and satisfies every single one of these conditions.

Presently, of all the validation methods available on the market, proof-of-work is the most common and is responsible for the most carbon emissions. Having said that, the Crypto Climate Accord, an initiative to reduce carbon emissions produced by crypto mining, is inviting individuals to contribute to this cause and save the environment. Over 250 individuals have signed up to decarbonize the industry by 2040.

Why do all cryptocurrencies rise and fall together

However, if you are looking at some other crypto, checking for the ecosystem inflation rate or yearly issuance percentage is an excellent metric to evaluate the price growth (or degrowth) over time. Crypto assets with low issuance percentages are more sought-after.

Metrics like trading volume to market cap ratio and the number of active markets also reflect investor interest. Research shows that cryptocurrencies with market caps exceeding $1 billion exhibit lower volatility and higher institutional interest. These factors contribute to their long-term sustainability and appeal.

Risk-on and risk-off environments, usually created by central bank policies and macroeconomic conditions, also play a major role in the movement of cryptocurrencies. These environments influence both traditional stocks and cryptocurrencies similarly. During a risk-on phase, investors are willing to take more risks, leading to a rise in the value of cryptocurrencies. Conversely, in a risk-off phase, investors tend to move towards safer investments, causing a decrease in the value of cryptocurrencies.

Technological advancements in blockchain security aim to prevent such incidents. Enhanced encryption protocols and decentralized systems reduce the risk of breaches, restoring trust among investors. However, even minor security concerns can create ripples in the market. This highlights the delicate balance between technological reliability and investor sentiment in determining cryptocurrency prices.